46

FMI

*

IGF JOURNAL

VOLUME 25, NO. 2

POPULAR (MIS)PERCEPTIONS REGARDING PENSION PLANS: RELATIONSHIP TO PUBLIC SECTOR PENSION PLANS

result - to the exclusion of other public

spending – it may result in a

decline

in

the overall health of the population

13

.

To summarize, for the employee who

is on a defined contribution plan and is

unlucky enough to retire in a market

downturn – even if that downturn is

temporary and the market corrects

shortly after – the die is cast and a

critical pillar in that individual’s income

security is sacrificed for the rest of that

individual’s life. This even after diligent

saving on the part of that employee

over their working years. The saying

is “invest for the long run” but in some

cases (as with the retirees under this

scenario) to paraphrase John Keynes, in

the long run we are all dead.

Conversely, for the individual on

a defined benefit plan, if said plan is

underfunded the day an employee

retires that underfunding can be

reversed during the retirees lifetime,

potentially in very short order, by a

market turnaround, an increase in

interest rates or more likely both

14

. This

would remove the pressure on taxpayers

to fund benefits for that retiree even

while providing income security for the

retiree over the entire period. In this

case, the long run works.

Conclusion

In seeking pension reform in the public

sector many of the claims made in the

press are erroneous. This paper has

sought to identify these and provide

factual information.

Further, in the Canadian market the

solutions proposed in the press may

paradoxically result in an increased

burden on government resources –

and thus taxpayers – not less

15

. In fact,

one shocking implication of this is that

private sector actors moving to defined

contribution plans are uploading risk

to the taxpayer! This paper lays out the

analysis behind this counter-intuitive

conclusion.

Of course this conclusion is not

definitive – a definitive statement would

have to rest on empirical evidence.

The actual outcomes of the changes

suggested in the press would be impacted

by a number of factors in addition to that

explored above, including the impact of

the loss of significant pooled investment

funds to the economy and the impact of

any change to pension plans on length

and quality of life of pension recipients.

Assuming, however, that the changes

to pension plans do not significantly

increase mortality among pension

recipients, the conclusion stated above

would be reasonably expected to hold

true.

Finally, in a public sector setting

moving to a defined contribution plan

from a defined benefit plan only changes

the area in the public sector in which

expenditure pressures are created.

The final conclusion to be drawn from

our investigation may well be that in

pursuing solutions, a holistic view is

mandatory and the uncritical application

of private sector solutions in a Canadian

public sector setting may well be

counterproductive.

13

“A society that spends so much on health care

that it cannot or will not spend adequately on

other health-enhancing activities may actually

be reducing the health of its population”.

“More

health care doesn’t mean better health”:

Globe and

Mail, Sep. 05, 2012 by Robert Brown.

14

This statement has proven to be prescient.

In the year since this paper was originally

written Mercer released a study showing that

in 2013 pension plans sponsored by S&P500

companies eliminated over 80% of their pension

underfunding. As at December 31, 2013, $454

billion of the estimated $557 billion deficit

at December 2012 was wiped out. This took

place in

one year

without any significant upward

movement in interest rates. Source: 2013 Best

Year on Record for US Pension Gains; Sponsors

Now Acting to Protect their Winnings.

15

This will depend on how the loss of resources,

or the security of those resources, impacts the

person’s length of life and thus extent of required

support from the public purse.

About the Author:

Richard Wright has a passion for contributing to solutions, whether to problematic

economic/finance issues or more local process inefficiencies. He has studied and worked

extensively in the finance/economics field. He received his undergraduate degree in

history and economics from the University of the West Indies and graduate degrees in

economics from Howard University in the United States and York University in Canada.

He also has an MBA from the Schulich School of Business. Over the past 10 years,

Richard has worked in the Ontario Provincial Government in the areas of finance, as well

as policy. Richard currently lives in the GTA (Ajax) with his wife Sandra and their two

daughters.

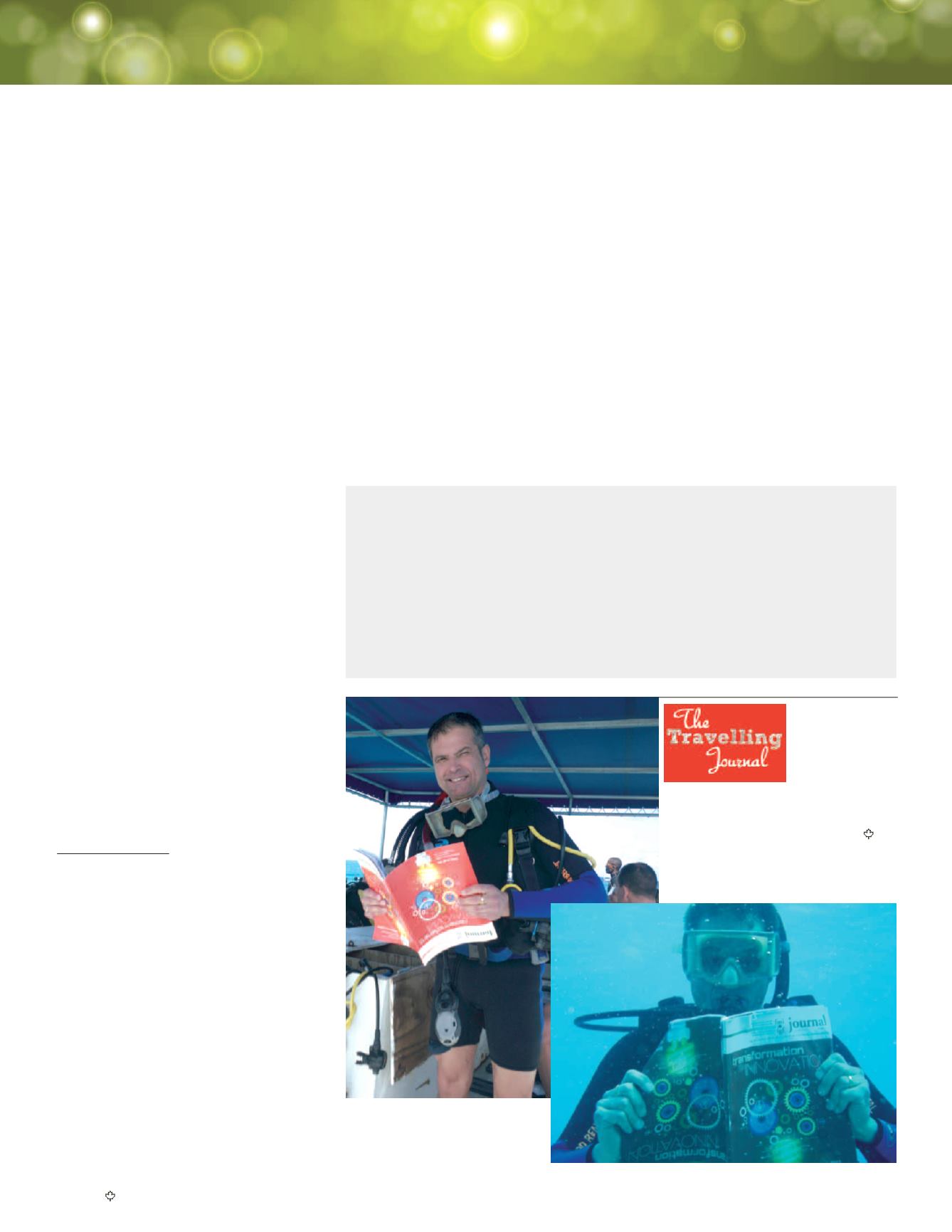

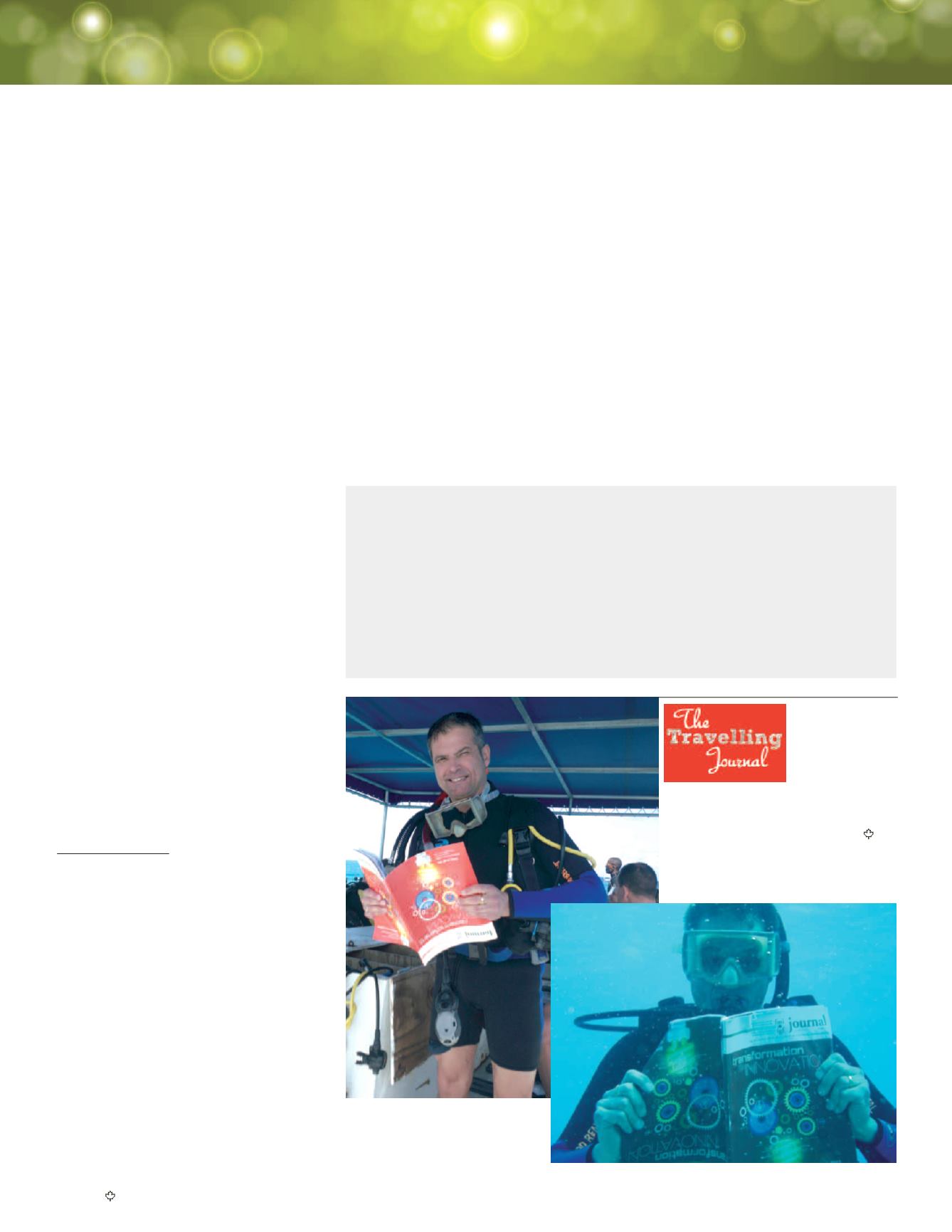

No one can question Marcel

Boulianne’s fervour for FMI. The FMI

National President brought his fmi

*

igf

Journal along with him while diving

off the coast of Grand Turk Island, the

capital island of the Turks and Caicos.

See other destinations of

“The Travelling Journal”

at

.